M and A

Wealth Management M&A Shrugs Off Market Turmoil – ECHELON Partners

.jpg)

The investment bank and advisor to the wealth management industry in North America gives its latest data, showing that for all the noise and market turbulence, the quarter clocked up the second highest number of deals on record.

While global equity markets have slid since the start of the year, with the worst losses during April after the US tariff announcement – it appears that in the first quarter at least, wealth management M&A was buoyant.

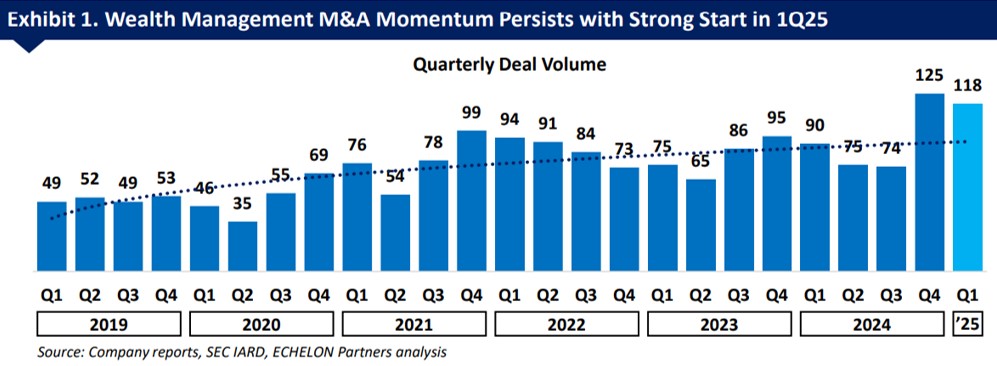

ECHELON Partners, the US investment bank and advisor to wealth managers, said that in Q1 2025, the sector recorded 118 announced transactions – the second most active quarter on record. ECHELON said it expects deal activity to break a record in 2025.

Source: ECHELON Partners

RIAs accounted for 73 per cent of total deal activity in the quarter, with 86 announced transactions. Although the number of RIA deals declined from the prior quarter, total transacted assets – excluding deals involving sellers with more than $20 billion in assets – increased by 7.6 per cent, reflecting a shift toward larger targets.

Financial acquirers announced 15 direct deals, almost matching the previous quarter. Despite fewer "mega-deals," total transacted assets by private equity firms increased from $34 billion to $56 billion compared with the final quarter of 2024.

In the year to date, average assets per deal stood at $1.587 billion.

In Q1 2025, there were 50 announced transactions involving at least $1 billion in assets, representing a 4.2 per cent increase relative to Q4 2024’s total of 48 $1 billion-plus deals.

Big deals

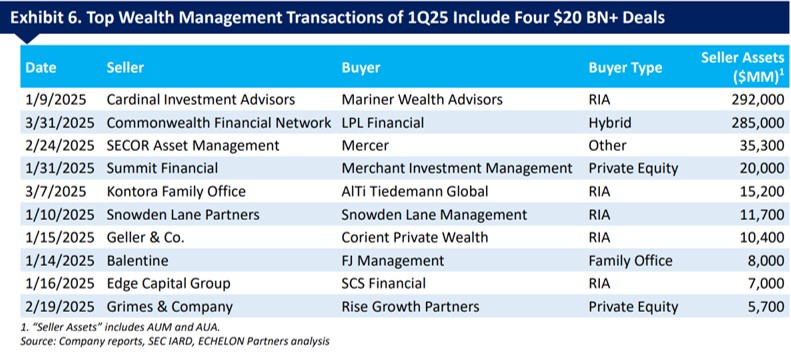

Notable acquisitions by strategic buyers include LPL Financial’s

acquisition of Commonwealth Financial Network for $2.7 billion

and Mariner Wealth Advisors’ acquisition of the $292 billion

[assets under administration] institutional consultant Cardinal

Investment Advisors that will become part of Mariner

Institutional, which Mariner founded in early 2024 via other

large acquisitions.

Significant deals by financial acquirers include Merchant Investment Management’s investment in $20 billion Summit Financial, a shift in its typical strategy as a minority investor, and Rise Growth Partners investment in $5.7 billion Grimes & Company.

Source: ECHELON Partners

The report said wealthtech witnessed more than 35 transactions in the quarter.